is not high, but the accounts receivable turnover rate and the adjusted cash collection ratio are low, which may be due to the large scale of the company’s PPP project and the long collection cycle; Shanxi construction investment has a slightly longer aging distribution, but it benefits from strengthening the clearing of accounts receivable in the province, and the collection quality and operation efficiency are good; Guangxi Construction Engineering Group Co., Ltd.

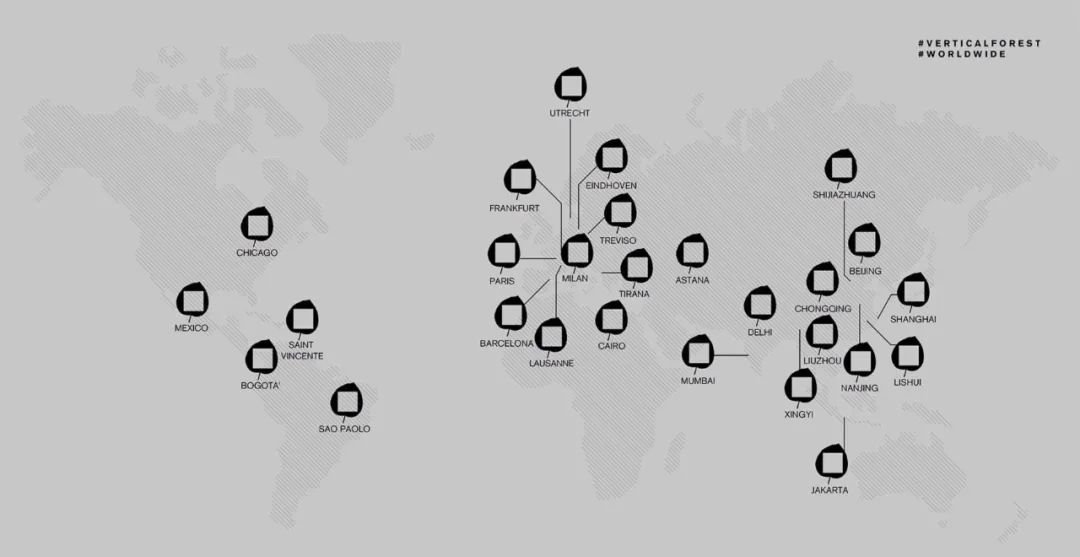

Figure 4: regional distribution of business of three enterprises note: the data comes from the 2020 annual report of the company, which is the first securities asset management sorting.

Therefore, in our analysis, we will restore the sustainable bonds and adjust the asset liability ratio, combined with the proportion of short-term interest bearing debts The cash flow coverage is compared with the solvency of the three enterprises.

The business type is mainly housing construction engineering, supplemented by electromechanical equipment installation, municipal engineering and highway engineering.

(2) Debt structure and solvency: Shanxi construction investment and Shaanxi Construction Engineering > Guangxi construction engineering construction enterprises often bear the debt reduction tasks assigned by the local SASAC, and generally reduce their liabilities by issuing sustainable bonds.

In terms of main construction qualification, Shaanxi construction engineering holds the most special grade general contracting qualification, including housing construction engineering, municipal public engineering, petrochemical engineering and highway engineering; Shanxi construction investment has other three types of special qualification except highway engineering; At present, Guangxi Construction Engineering Group has only two special grade general contracting qualifications for construction engineering and municipal engineering construction, and the qualification level is relatively weak.

is a high capital advance industry, capital occupation is an important indicator affecting asset quality, and the large scale of accounts receivable may reflect the poor cash return status of the enterprise; Long aging and high customer concentration will increase the risk of bad debts, which will put some pressure on the capital chain.

In 2020, the construction business realized a revenue of 112.861 billion yuan, accounting for 93.73% of the total operating revenue; Shanxi construction investment Co., Ltd.

Figure 5: asset quality analysis of three enterprises note: the data comes from the company’s 2020 annual report, which is the first securities asset management arrangement.

In terms of business type, Shaanxi Construction Engineering Group is mainly engaged in construction and installation business.

In the construction industry (V), by splitting the interest bearing liability structure of the main body of Provincial Construction Engineering, we come to the conclusion that provincial construction engineering enterprises take bank loans as an important external financing channel..

Figure 7: cash flow analysis of financing activities of three enterprises note: indicators follow the definition of Architectural Research (II); The data is taken from the 2020 annual report, which is the first to be sorted out by securities asset management.

On the whole, the three companies have strong regional competitive advantages in the province, but at the same time, they face a certain risk of regional concentration.

The analysis of relevant indicators shows that the adjusted asset liability ratio of Shaanxi Construction Engineering Group Co., Ltd.

In terms of newly signed orders, Shaanxi Construction Engineering Group Co., Ltd.

has weak bargaining power and relies more on downstream payment collection, but the customer concentration is low and the investment scale of PPP project in the future is small.

(2) Newly signed orders and regional distribution: the newly signed contracts are large in scale and concentrated in regional distribution.

(1) capital occupation and collection: Shanxi Construction Investment Group Co., Ltd.

has the largest amount of newly signed contracts.

> Shaanxi Construction Engineering Group Co., Ltd.

Other businesses are mainly expanded based on the upstream and downstream of the industrial chain, of which the revenue from commercial logistics is 20.076 billion yuan, accounting for 16.6%, and the revenue from real estate development is 740 million yuan, accounting for 7.4% of the total revenue.

On the whole, the new contract amount of the three enterprises is relatively large, which provides a strong guarantee for future revenue growth.

is high, mainly short-term interest bearing debt, and there is great pressure on immediate debt repayment, but the good profitability provides a strong guarantee for debt repayment; The debt of Shanxi construction investment tends to be long-term, and the debt structure is good, but the excessive sustainable financing (9.441 billion yuan) aggravates the debt burden of the company; The coverage of Guangxi Construction Engineering Group’s monetary funds on interest bearing debt is weak, the unrestricted monetary funds can not fully cover the short-term interest bearing debt, and the solvency needs to be improved.

On the whole, the three enterprises all take construction as their main business.

(3) Refinancing flexibility: Shanxi construction investment and Shaanxi Construction Engineering > Guangxi construction engineering construction enterprises generally undertake more infrastructure projects, with large initial expenditure scale and relatively long payment collection cycle.

Figure 2: main business types and revenue proportion of the three enterprises note: the data comes from the company’s 2020 annual report, which is the first securities asset management sorting.

Compared with Guangxi Construction Engineering Co., Ltd., the business of Guangxi Construction Engineering Co., Ltd.

02 – financial characteristics: Shaanxi Construction Engineering Group Co., Ltd., Shanxi construction investment collection is guaranteed, and Guangxi Construction Engineering Group Co., Ltd.’s solvency needs to be improved.

In the first quarter of 2021, the newly signed orders for core business totaled 69.093 billion yuan (excluding steel structure, ancient buildings and other projects), of which housing construction accounts for the highest proportion; In the first quarter, the newly signed contract amount of Shanxi construction engineering group was 43.789 billion yuan, and the growth rate of infrastructure investment projects slowed down due to the influence of local finance; In 2020, the contract amount of new construction projects signed by Guangxi construction engineering group decreased slightly by 2.49% year-on-year, but it remained at a large scale, and the project reserve was sufficient.

Figure 6: analysis of solvency of three enterprises note: the data comes from the 2020 annual report of the company, which is the first securities asset management sorting.

is mainly engaged in construction and infrastructure investment and construction.

This paper selects three bond issuers, Shanxi construction investment, Shaanxi Construction Engineering and Guangxi construction engineering, which have similar regional environment and concentrated business scope in the province, to further clarify the core competitiveness and potential risks of each subject through the horizontal comparison of operation, financial quality and refinancing elasticity, so as to provide a higher margin of safety for bond selection.

By analyzing the cash flow generated from financing activities, it is found that Shaanxi Construction Engineering Group Co., Ltd.

also focuses on construction, but the business concentration has decreased.

In 2020, the construction business achieved an income of 63.31 billion yuan, accounting for more than 80% of the core business income; Guangxi Construction Engineering Group Co., Ltd.

By the end of 2020, the revenue from construction, installation and construction business accounts for less than 70%.

In the construction industry (V), we put forward the method of “studying the credit fundamentals of provincial construction enterprises with the idea of urban investment”, and made a comparative analysis on the construction fundamentals of various provinces.

By analyzing relevant indicators, it is found that the accounts receivable of Shaanxi Construction Engineering Group Co., Ltd.

benefited from the capital injection from shareholders, the cash received from investment increased by 8.337 billion yuan, and realized a net cash inflow of 4.207 billion yuan in 2020.

01 – Business commonality: focus on the province, with strong regional advantages, but facing certain concentration risks (1) construction qualification and business type: complete qualification.

has a net outflow of financing cash flow of 4.174 billion yuan in 2020 due to a large amount of repayment of due debts, which is highly dependent on external financing; The net cash flow generated from the financing link of Shanxi construction investment in 2020 was 8.556 billion yuan, which was due to the increase of bank loans and the issuance of multi-term bonds to expand the financing scale; Guangxi Construction Engineering Group Co., Ltd.

Chart 1: comparison of special-grade general contracting qualifications of three enterprises note: the data comes from the company’s annual report, which is the first securities asset management sorting.

In terms of regional distribution, Shaanxi Province is still the main construction area of Shaanxi Construction Engineering Group, accounting for 75.86% of the newly signed contracts in the province in 2020, and the contribution rate of Xi’an will reach 50.66%; The business areas of Shanxi construction investment are also concentrated in the province, accounting for 78.67% of the newly signed contracts in the province in 2020 and 82.05% in the first quarter of 2021; In the 2020 revenue of Guangxi construction engineering group, the revenue in Guangxi autonomous region accounted for 76.15%, which has strong market competitiveness in the field of construction in Guangxi.

Figure 3: new contract amount of three enterprises (RMB 100 million) Note: the data comes from the company’s 2020 annual report, which is the first securities asset management sorting.

Therefore, the coverage of due debts is mainly realized through financing cash flow turnover.

> Guangxi Construction Engineering Group Co., Ltd.

Overall, the three enterprises are important construction enterprises with leading professional technology and rich construction experience in the province, and have strong project undertaking ability.

is relatively diversified, which is mainly the upstream and downstream extension of the company’s main construction business.