They are used to prevent rainwater, groundwater, industrial and civil water supply and drainage, corrosive liquids from invading buildings, and also prevent the invasion and damage of moisture and steam in the air to buildings.

2.

02 competition pattern (I) market scale according to the statistics of China building waterproofing Association, in 2021, 839 waterproof Enterprises above Designated Size (with a main business income of more than 20million yuan) achieved a total operating income of 126.159 billion yuan, an increase of 13.20% year-on-year, and the growth rate increased by 8.6% compared with the same period last year; The total profit was 7.564 billion yuan, a year-on-year increase of 2.04%.

Restricted by product weight, product nature, transportation conditions and transportation costs, the economic transportation radius of waterproof materials is about 500 kilometers, while the project location of downstream customers is usually all over the country, and the industry concentration is limited by the service radius.

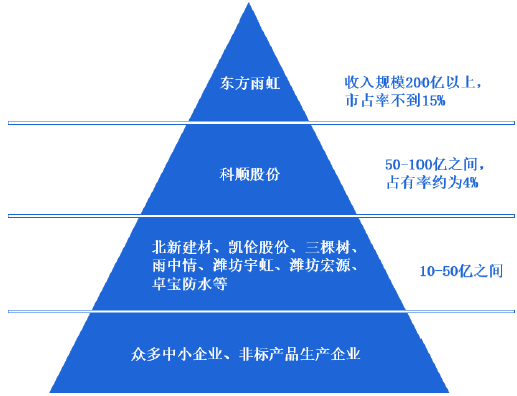

(2) Competition pattern the waterproof industry presents a pattern of “one super and many strong”.

Among them, Dongfang Yuhong is the only enterprise with a revenue scale of more than 20billion, accounting for less than 15% of the market, Keshun shares accounting for about 4%, Beixin building materials, Karen shares and other enterprises with low single digit market share, and the rest are many small enterprises and non labeled product manufacturers.

The last time I wrote the case study of Keshun’s acquisition of Fengze shares, I noticed the building waterproof material industry.

About 60% of the downstream waterproof material industry is housing and buildings, 20% is infrastructure, and 20% is the stock renovation market.

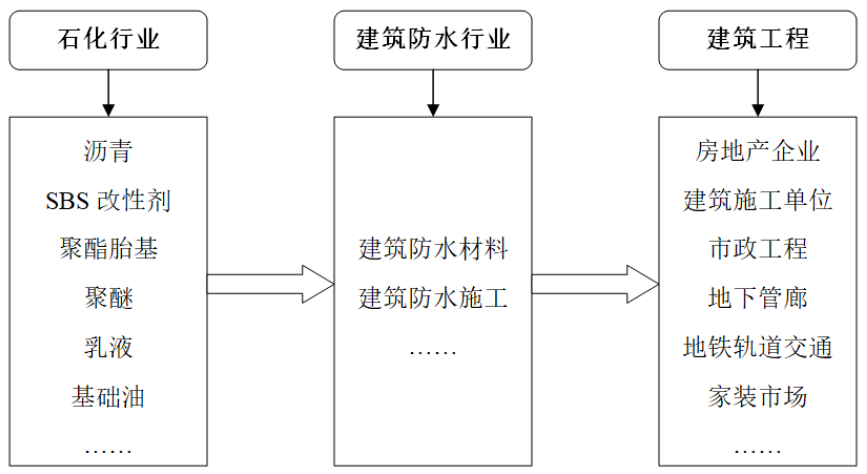

Waterproof materials are mainly used in housing construction, high-speed railway, expressway, urban road and bridge, subway, urban rail, airport, underground pipe gallery, water conservancy facilities and other fields, so they are greatly affected by real estate industry and infrastructure investment.

At the 35th anniversary of the founding of the China building waterproofing Association in 2019, Mr.

Since the 1980s, with the rapid rise of the construction industry, China has developed modified asphalt waterproof coiled materials and synthetic polymer waterproof materials, and added SBS or app and other modifiers to improve the high and low temperature performance and durability.

Many waterproof enterprises, such as Dongfang Yuhong, Keshun shares, ZhuoBao technology, etc., were established around 2000.

In building construction, waterproof materials form an integral waterproof layer on the surface of the building, which increases the waterproof and anti leakage ability of the building.

The industry standard was issued late and relatively loose, resulting in a large number of non-standard small and medium-sized enterprises in the industry..

Waterproof materials such as modified asphalt coiled materials have risen to the leading waterproof materials in many countries.

The raw materials required for the production of upstream waterproof materials are mainly asphalt, SBS modifier, polyester matrix, base oil, polyether, etc., of which asphalt accounts for the largest proportion.

Today, let’s take a look at the industry specialized in preventing and treating “building cancer” – building waterproof material industry.

Asphalt suppliers are mainly three barrels of oil (PetroChina, Sinopec, CNOOC) and some local refineries.

Its quality and application effect are directly related to the structural effect and service life of the building engineering.

(2) The upstream of the waterproof material industry chain of the industry chain is the petrochemical industry represented by asphalt, the midstream is the waterproof material manufacturer, and the downstream is the housing construction, expressway, urban road and bridge, subway and other construction contractors.

The market share of the top four enterprises in the market is less than 20%, the industry concentration is low, and the market share of leading enterprises can be increased.

Raw materials are greatly affected by the international crude oil market.

The full text is 4290 words.

Second, the barriers to entry are low.

From 2000 to 2015, the penetration rate of new building waterproof materials increased from 34.88% to 94.26%.

Li Weiguo, the current president of the China building waterproofing Association and chairman of Dongfang Yuhong, wrote that the scale of the waterproofing industry reached more than 200 billion, that is, many small enterprises still accounted for a relatively high proportion.

At present, in China, building leakage has become the second major problem affecting the quality of buildings besides building structures, which is called “building cancer”.

03 industry characteristics (I) low concentration China’s waterproof industry is still in an immature stage of low-end overcapacity, low industrial concentration and irregular market competition, presenting a pattern of “large industries and small enterprises”.

1.

There are three main reasons for the low concentration of waterproof industry: first, there is a service radius.

Industry analysis belongs to the basic skill of investment banking, and I personally like to see the industry, so I will update some industry analysis from time to time in the future, and we will improve and learn together.

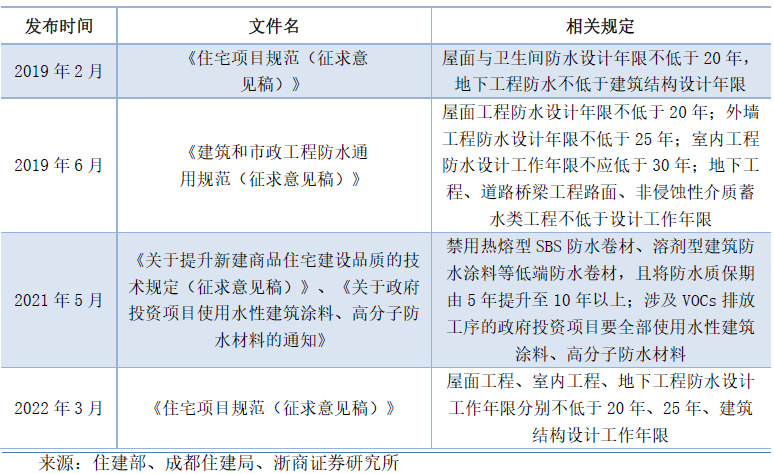

In January 2013, the Ministry of industry and information technology officially issued the “entry conditions for building waterproof membrane industry”.

Third, the supervision is not strict.

01 Industry Overview (I) definition and origin building waterproof materials are an important part of building functional materials.

After oxidation, the reinforcement will expand more and more, which will squeeze the main structure, cause safety problems, and the vicious cycle will continue, which will reduce the service life of the building.

Due to the high concealment of waterproof materials and large operational space, there are a large number of non-conforming products and local non-standard small enterprises.

The original asphalt felt originated in Europe, was introduced into China in the 1920s, and began production and application in China in the 1940s.

The waterproof material industry standard was issued relatively late.

The first modern building waterproof materials began with the discovery of natural asphalt as waterproof materials.

Leakage will lead to the rust expansion of the reinforcement.

Note: “non-standard” refers to “non-national standard”, which refers to inferior products produced below the national standard.

The quality of non-standard products is far lower than the national standard, with poor waterproof performance and short service life, which will bring various hidden dangers such as house leakage.

According to the statistics of China building waterproofing Association, the average leakage rate of houses across the country is 65%, and the leakage rate of underground buildings is more than 80%.

Recently, mandatory standards will be issued.

The concentration of suppliers is high, so the voice of waterproof material enterprises is relatively weak.

On the one hand, waterproof material enterprises are asset light, and the investment in fixed assets is small; On the other hand, the quality control of material production is difficult to grasp.

It takes 4 minutes to skim and 8 minutes to read in detail.